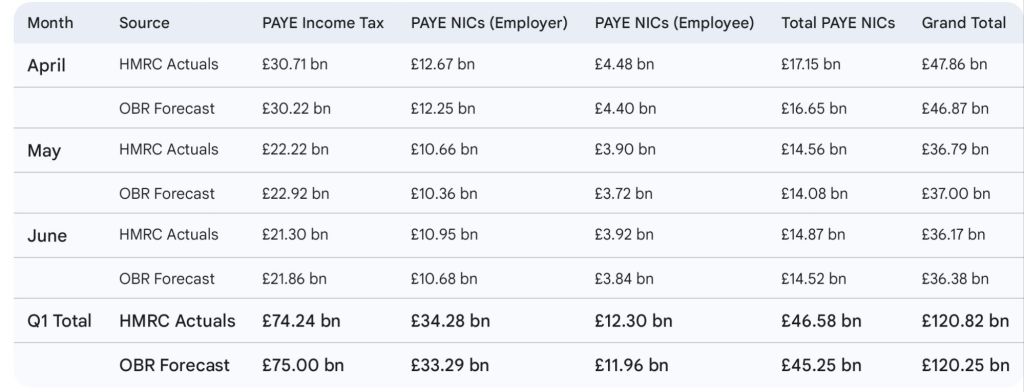

“PAYE income tax and NICs cash receipts were £36.6 billion in June, £0.2 billion (0.4 per cent) below forecast, and £3.5 billion (10.7 per cent) above last year. The year-on-year comparison is being boosted by the rate and threshold changes to employer NICs. Receipts of employer NICs were up 23.8 per cent in June from a year earlier. For the year to date, PAYE income tax and NICs receipts are £0.6 billion (0.5 per cent) above forecast.” – Commentary on the public sector finances, June 2025, by Office for Budget Responsibility.

Click to access PSF-commentary-June-2025.pdf

I must admit I was surprised, I believed that the increases to Employers National Insurance would have an immediate knock on effect and fall below the OBR’s forecast. The hike to National Insurance was forecast to raise £25 billion annually, and I was sceptical that it would get anywhere close to that. Current trends do however show that not only is National Insurance on track, it’s actually slightly ahead of expectations.

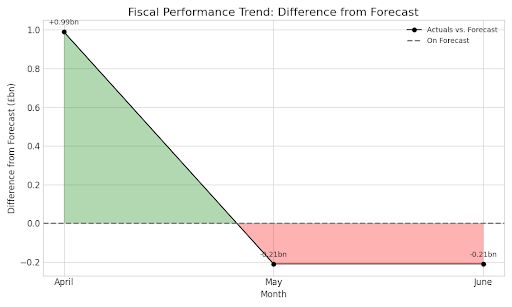

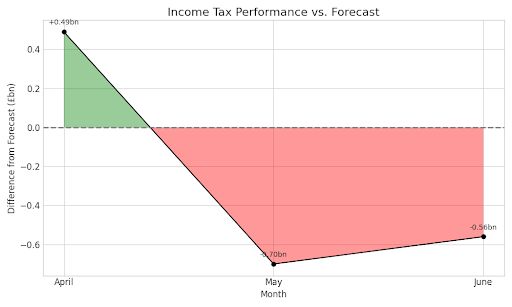

What’s worrying however, is the very sudden drop off in income tax receipts vs the OBR forecast. In fact, £1 billion of the £0.6 billion overall surplus is attributed to April income tax and National Insurance Receipts being high relative to OBR forecasts. Since then, the following two months are lagging at an average of £0.21 billion per month, £0.63 billion for income tax. Is the April over performance due to Companies modifying their behaviour causing a one off spike? Is this a worrying further trend that will quickly turn a surplus into further deficit?

What is certainly true however, is that the National Insurance Hike has increased revenues, but for how long? Job openings fell 5.8% between May and July, and Unemployment was up. The focus on the July HMRC return will be one i’ll be looking at with interest!